To qualify for Medicaid (also known as Title 19), you must meet both the asset and income eligibility rules. In a companion blog, we discussed the 2018 Medicaid income rules. Now let us review the Medicaid asset rules.

First, you will need a little Medicaid background. A “Community Spouse” is the term used for a healthy spouse of a Medicaid applicant. The spouse applying for Medicaid is referred to as the “Institutionalized Spouse.” Certain assets are “excluded assets” when determining Medicaid eligibility. The rest of the couple’s assets are considered “countable assets.” When a married person applies for Medicaid, the institutionalized spouse will not qualify until the couple’s combined assets are within certain eligibility limits. The amount the couple must spend to qualify for Title 19 is called “the spend down amount.”

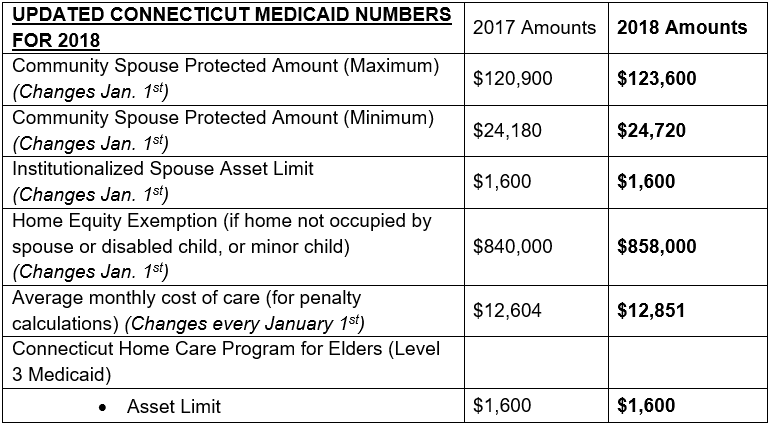

The Institutionalized Spouse only gets to keep $1,600 in assets (Institutionalized Spouse Asset Limit). However, the Community Spouse can keep the “Community Spouse Protected Amount” (referred to in some states as the “Community Spouse Resource Allowance”). The first two numbers in the chart below help determine the Community Spouse Protected Amount (“CSPA”).

To determine the CSPA, all of the couple’s countable assets, regardless of which spouse owns the asset, are added up. This total is then divided in two portions. One portion is preliminarily allocated to each spouse. The Community Spouse portion is then measured against the Maximum CSPA and the Minimum CSPA figures. The Community Spouse portion must fall between the Maximum CSPA and Minimum CSPA. There are only three possible scenarios. So, let us look at three scenarios.

Scenario #1: Below the Minimum CSPA - If Couple has $40,000 in countable assets, then CSPA = $24,720

$40,000 ÷ 2 = $20,000

$20,000 falls below the CSPA Minimum of $24,720. Therefore, the Community Spouse gets to keep more than ½ of the couple’s countable assets. The Community Spouse gets to keep the CSPA Minimum of $24,720. The Institutionalized Spouse gets to keep $1,600. The spend down amount is $13,680 [$40,000 – ($24,720 + $1,600)]

Scenario #2: In-between the Minimum CSPA and Maximum CSPA- Couple has $100,000 in countable assets, then CSPA = $50,000

$100,000 ÷ 2 = $50,000

$50,000 falls between the CSPA Minimum of $24,720 and the CSPA Maximum of $123,600. Therefore, the Community Spouse gets to keep $50,000 of the couple’s combined countable assets. The Institutionalized Spouse gets to keep $1,600. The spend down amount is $48,400 [$100,000 – ($50,000 + $1,600)]

Scenario #3: Above the Maximum CSPA - Couple has $300,000 in countable assets, then CSPA = $123,600

$300,000 ÷ 2 = $150,000

$150,000 falls above the CSPA Maximum of $123,600. Therefore, the Community Spouse only gets to keep $123,600 of the couple’s combined countable assets. The Institutionalized Spouse gets to keep $1,600. The spend down amount is $174,800 [$300,000 – ($123,600 + $1,600)]

The balance of the couple’s countable assets must be spent down or converted into excluded assets to achieve Medicaid eligibility (unless the CSPA is increased through a showing of need at a Fair Hearing). The process of reducing countable assets to within eligibility limits is often referred to as an asset “Spend Down” See our blog entitled What is a Medicaid Spend Down for how to spend down to qualify for Medicaid.

If you would like more information on whether you or a loved one qualify for Medicaid, contact the elder law attorneys at Cipparone & Zaccaro, PC to discuss your situation. Call (860) 442-0150 today.