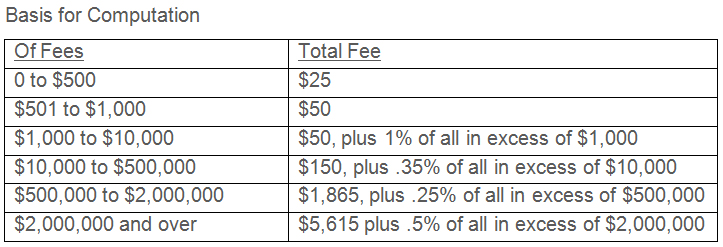

New Fee schedule effective person’s dying on or after January 1, 2015

The Governor’s budget that passed in the general assembly in June provided zero funding for the Probate Court system creating an approximate $32 million shortfall for the next two fiscal years. In order to keep the Probate courts afloat, the general assembly included increases in the probate court fees as part of the budget implementer bill. What does this mean for Connecticut residents? Connecticut now funds its probate court system entirely from user fees. According to Probate Court Administrator, Paul Knierim, in a recent Hartford Courant editorial, Connecticut now has the most expensive probate courts in the United States and will be sending out six- and seven-figure invoices for probate fees.

Under prior law, the highest probate fee payable was capped at $12,500. This fee maxed out for estates of $4,754,000 and over. Under the new law effective for estates in which a person dies on or after January 1, 2015, the fees for estates under $4,754,000 remain the same. However, there is no longer a cap on the probate fee for estates over $4,754,000. Estates totaling $2,000,000 and over will now pay $5,615 plus .5% of all in excess of $2,000,000. For example, a $10 million estate will now incur a fee of $45,615 under this new schedule. The new fee schedule is listed below.

Who is subject to probate court fees?

The probate court fees are essentially a tax that applies to a person’s estate regardless of whether the probate court has any involvement in the transfer of the person’s assets at death. Unlike most states, Connecticut is one of the few states in the country that includes property passing outside of probate in calculating fees on a decedent’s estate. For example, a person may plan to avoid probate by having all of his or her assets held in a lifetime revocable trust, or pass to beneficiaries via survivorship designations (such as jointly owned real estate or bank accounts), or pass via beneficiary designations (such as retirement plans or life insurance proceeds). This is a common planning tool in other states. Nonetheless, the Connecticut probate court fee still applies to these types of assets because they are part of the deceased person’s gross taxable estate.

How can one avoid Connecticut probate court fees?

For many people with average wealth, the new probate court fees will have little effect on their estates. For those who might be impacted by the fee increase, there are a few options.

One way to minimize or avoid the probate fee is to change your domicile to another state, such as Florida, and move the majority of your property to that state. The Connecticut probate court fee applies to a deceased person who is domiciled in Connecticut on the date of his or her death, and applies only to that person’s real property or tangible personal property located in Connecticut. Property of the deceased person situated outside of this state is excluded. For a person who was not domiciled in Connecticut on the date of his or her death but who owned real property or tangible personal property in this state, such real property or tangible personal property situated in this state is included in the basis for Connecticut probate fees.

Another option is to plan for the probate fee and purchase sufficient life insurance to cover the expected fee. Yet another option is to utilize lifetime gifting strategies to move wealth to your family in order to reduce your taxable estate.

If you are concerned over the impact the new probate court fees may have on your estate, contact us today to review your situation and discuss planning options suitable for you and your goals.

[If the basis for fees is less than ten thousand dollars and a full estate is opened, the minimum fee shall be one hundred fifty dollars.]