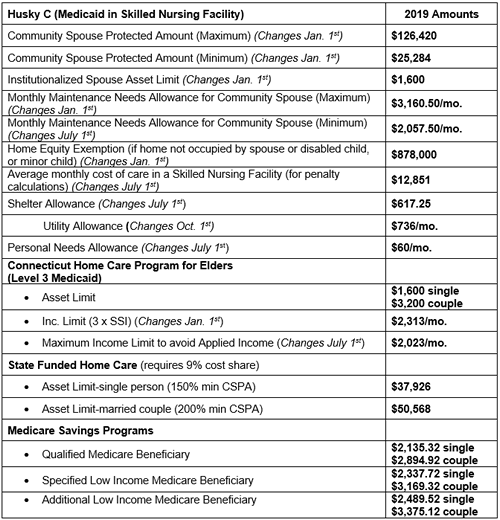

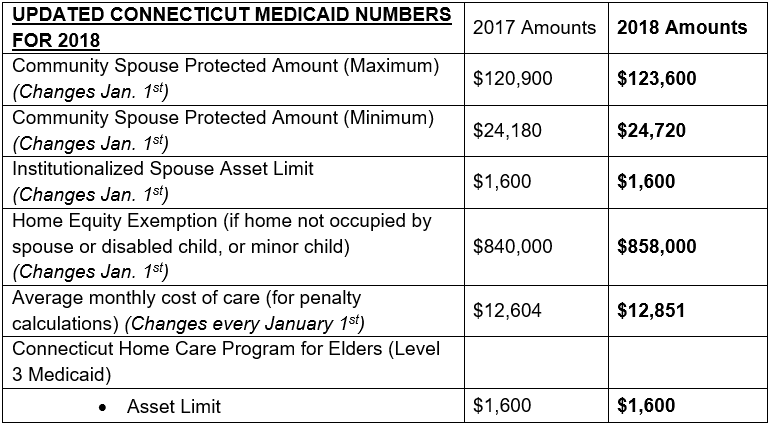

To qualify for Medicaid (or Title 19 as it is sometimes called), you must meet both the income and asset eligibility rules. This newsletter will cover the Connecticut income rules. (Visit our website for the Connecticut asset rules.)

To understand the income rules, you will need a little Medicaid background. A “Community Spouse” is the term used for a healthy spouse of a Medicaid applicant who is living in the community. The spouse applying for Medicaid is referred to as the “Institutionalized Spouse.” The income rules vary between Medicaid for a nursing home and Medicaid for home care. We will start with nursing home Medicaid.

First, the Community Spouse’s income is not counted and, thus, the Community Spouse may keep all of his or her income. The Institutionalized Spouse’s “Applied Income” is what is used for his or her medical expenses, including nursing home charges, with two exceptions: 1.) the Personal Needs Allowance of $60 per month; and 2.) the Community Spouse Allowance.

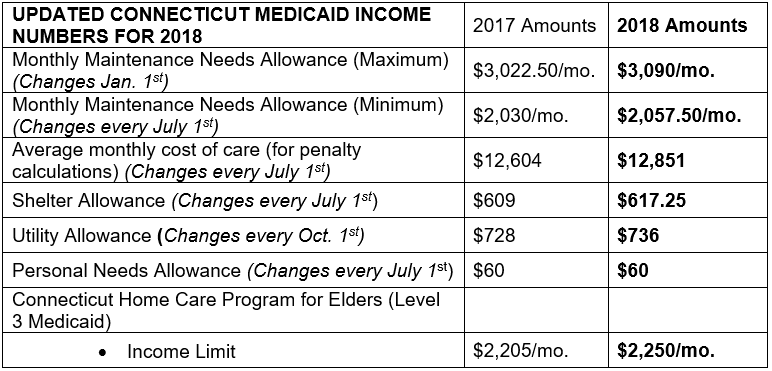

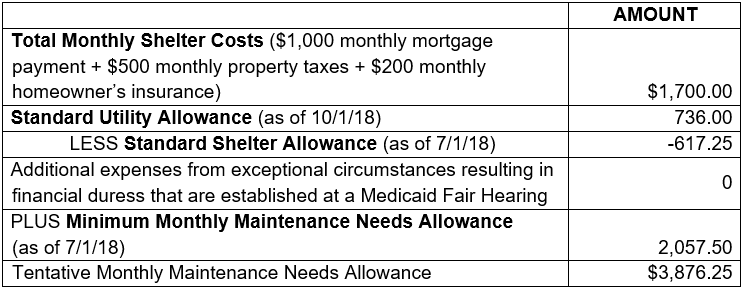

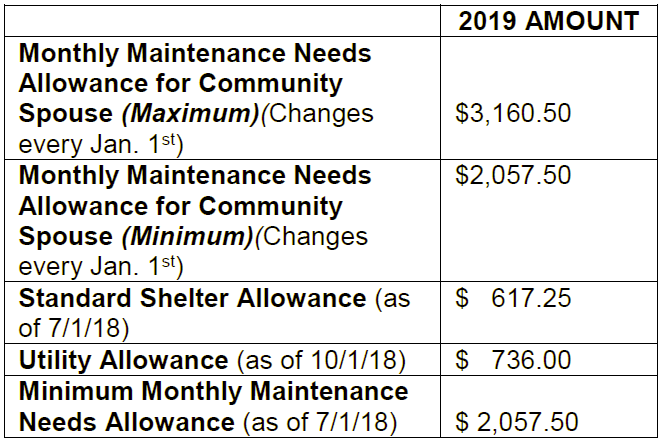

As with most things related to Medicaid, determining the Community Spouse Allowance is a complicated procedure. To begin: 1.) Total the Community Spouse’s rent, mortgage, real property taxes, condo fees and house / condo insurance; 2.) Add the standard Utility Allowance (see below for the latest allowance figures); 3.) Subtract the standard Shelter Allowance. This total gives us the monthly Excess Shelter Costs of the Community Spouse; 4.) Add the Excess Shelter Costs to the Minimum Monthly Maintenance Needs Allowance. This total cannot be higher than the Maximum Monthly Maintenance Needs Allowance; 5.) Subtract the Community Spouse’s actual income from this figure. If the result is a positive number, then this is the amount of the Community Spouse Allowance. The Community Spouse Allowance passes from the Institutionalized Spouse’s income to the Community Spouse each month. The Allowance reduces the Applied Income paid to the nursing home each month. The State of Connecticut will pay the balance of the nursing home bill.

Here is an example of how this calculation works. John is the Institutionalized Spouse and Margaret is the Community Spouse. John earns $4,000 per month income from social security and his pension. Margaret earns $1,000 per month in social security income.

Margaret’s mortgage is $1,000 per month. Her real estate taxes are $500 per month, and her homeowner’s insurance is $200 per month. With the average cost of nursing home care in Connecticut reaching $12,851 in July, 2018, John will need Medicaid coverage to afford this cost. The following is the calculation of the Community Spouse Allowance:

Because the Tentative Monthly Maintenance Needs Allowance is greater than the maximum Monthly Maintenance Needs Allowance of $3,090, Margaret’s MMNA is only $3,090. Then subtract Margaret’s monthly gross income of $1,000 and the total for her Community Spouse Allowance is $2,090.

Because John’s monthly gross income of $4,000 exceeds Margaret’s Community Spouse Allowance by $1,910, John keeps $1,910 per month. John receives his Personal Needs Allowance ($60 as of 7/1/18), pays his Medicare premium of $135.50 and the remaining amount, $1,714.50, is John’s Applied Income that he must pay each month toward his nursing home costs.

If John did not have sufficient income to pay the Community Spouse Allowance, Margaret could seek to keep more of the couple’s assets to generate the income shortfall. She would need to request a Fair Hearing and present evidence of her need to retain more of the couple’s assets to generate sufficient income.

If John were to apply for Medicaid to pay for home care instead of nursing home care, these are the calculations: The home care income limit for Medicaid under the Connecticut Home Care Program for Elders (changes every January 1st) is only $2,313 per month in 2019. John’s income exceeds the cap. Consequently, John would not qualify for Medicaid under the Home Care Program unless he diverts the $1,687 of excess income to a Pooled Trust. For more details on Pooled Trusts, see our blog What is a First-Party Special Needs Trust?

John could also apply for the state-funded Connecticut Home Care Program for Elders. The state-funded home care program provides the same services as the Medicaid home care program, but it requires the applicant to pay 9% of the cost of the care and has cost caps. The asset limit in 2019 is $37,926 for a single person and $50,568 for a couple. There are no income limits for the state-funded program. The maximum amount the state-funded program will pay for Category 2 (3 or more critical needs) is $2,909 per month; or, for Category 5 (1 or 2 critical needs) no more than 14 hours per week for a personal care attendant or 6 hours per week for a homemaker. The applicant pays the amount that exceeds the cap. Only access agencies that contract with the Connecticut Dept. of Social Services can provide the services. A care manager from the access agency will determine the level of care.

For more information regarding whether you or a loved one qualify for Medicaid or state-funded programs, contact the elder law attorneys at Cipparone & Zaccaro, P.C. to discuss your situation.